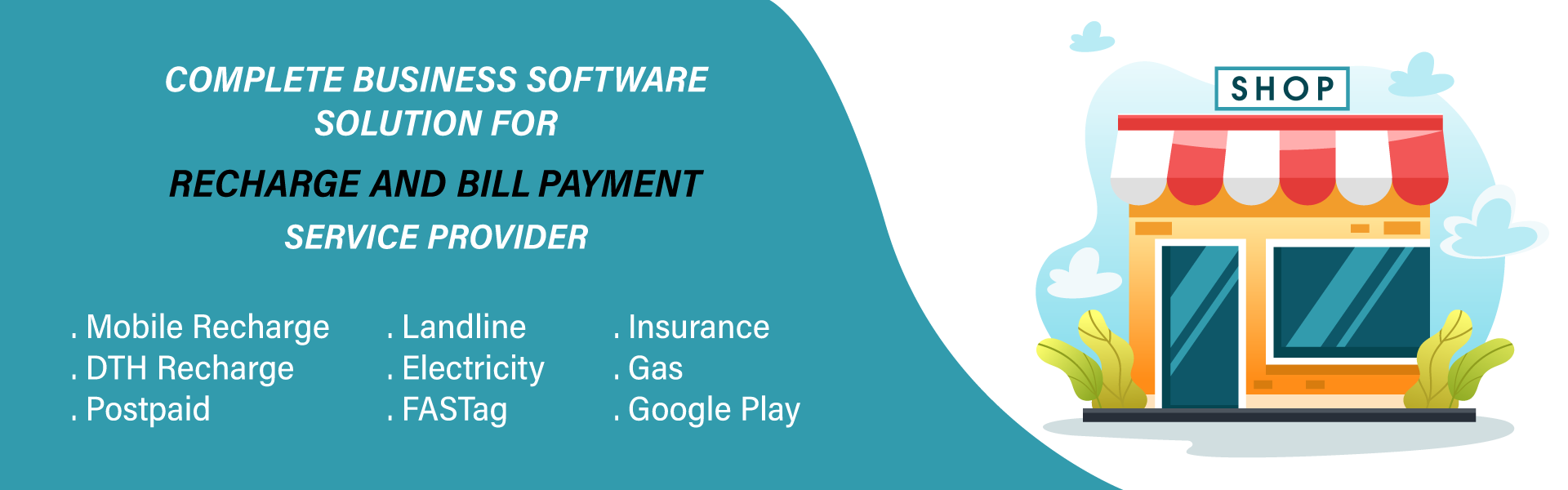

Multi Recharge Service is a company specializes in Mobile, Data Card and DTH recharge technologies. This is India's first 24/7 recharge platform that provides recharge facilities of all the telecom service providers.

Bharat Bill Pay eases the payment of bills and improves the security and speed of bill pay. An instant confirmation is generated for the bill payments. Currently you can pay bills for GAS, Electricity, Water, DTH and Telecom billers.

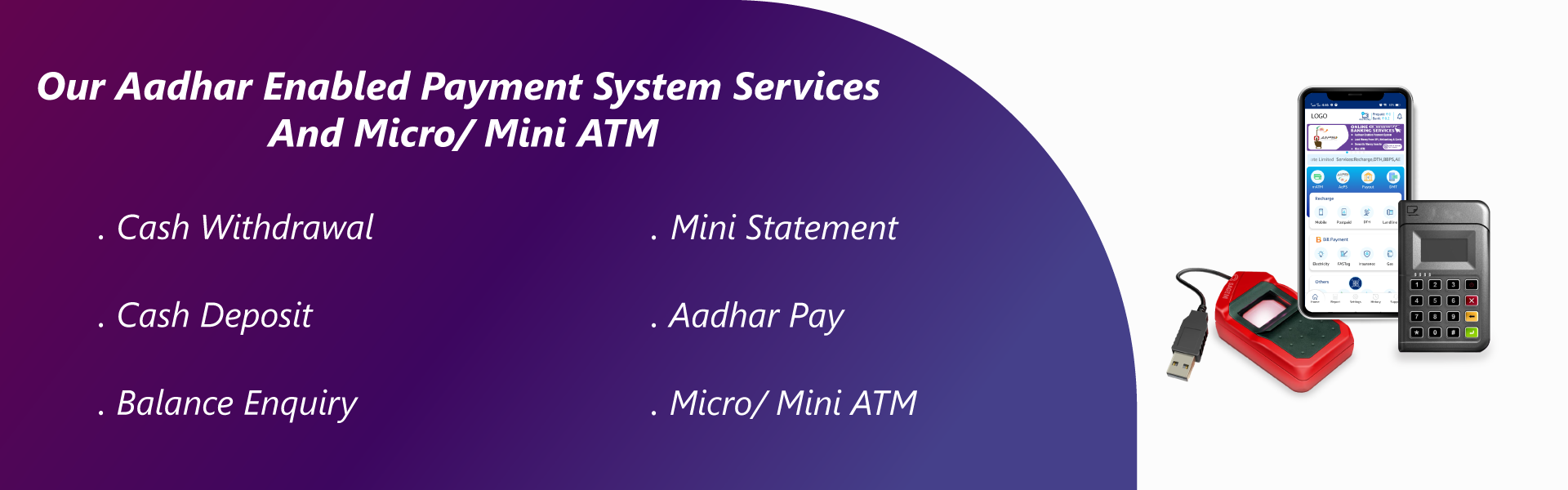

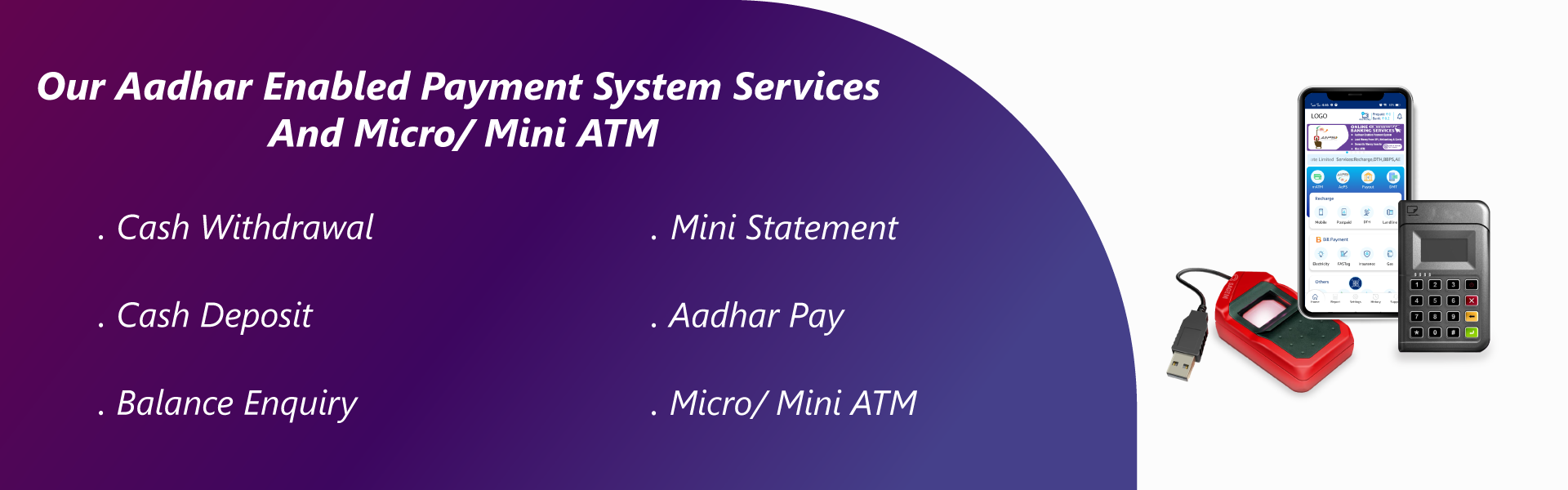

Cash Withdrawal is any amounts withdrawn in cash by the Cardholder from the Bank,ATM or from any other authorised bank or financial institution by utilising the Card and the Card facilities made available to the Cardholder.

The best way to take payments from your customers. A customer needs his Aadhaar number and his presence at the counter. The Micro-ATM comes with a biometric scanner which enables the authentication.

The Balance Inquiry process is associated with customer accounts and is used to check the amount remaining on a customer's store credit voucher, gift card, or gift certificate.

Mini ATM is a banking innovation that can server any bank. The Mini ATM Machime is operated by us that will include a card reader for all Cash Withdrawal and Balance Enquery transaction from all bank Debit Cards.

A leading software recharge, aeps development company that offers custom software development, website development, mobile app development for android and other web related services.

AEPS (Aadhar Enabled Payment System) is a new payment service offered by

the National Payments Corporation of india to bank, financial institutions using 'Aadhar' number and

online UIDAI authentication thought their respective Business correspondend service centers.